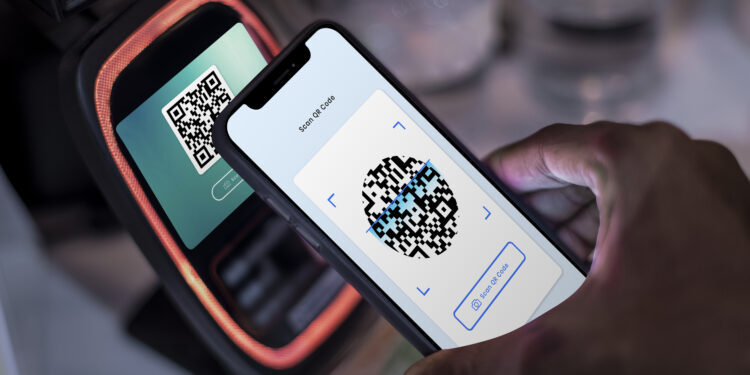

The Unified Payments Interface (UPI) has completely transformed the way Indians conduct transactions, leading the country towards a cashless economy. UPI’s revolutionary payment system has propelled India into a future driven by seamless digital transactions. Since its launch in 2016, UPI has become the preferred payment method for many Indians, fostering an inclusive financial system. Today, the scan-and-pay UPI system is used for transactions of all sizes, from luxury purchases worth thousands of rupees to a simple 10-rupee cup of tea.

The user-friendly interface and convenience of UPI have simplified payment procedures, empowering small businesses to improve their financial performance and open new paths for growth and expansion. According to reports, UPI transactions are expected to steadily grow and reach an impressive milestone of 1 billion daily transactions by 2026–27.

UPI has been making India a global leader in next-generation real-time payments infrastructure. In developed countries, merchants typically have Point-of-Sale (POS) terminals for payments, but a few years ago, many Indian merchants lacked such infrastructure. UPI emerged as a pivotal player in revolutionizing the country’s payment landscape.

Currently, UPI reigns supreme as the most favored digital payment method for end users. Its popularity can be attributed to its free, safe, swift, seamless, flexible, and convenient features. With constant advancements in technology and changing consumer preferences, the UPI payment ecosystem is continuously evolving, becoming more accessible, efficient, and secure.

In this article, we explore UPI’s significance in India’s transition to a cashless economy and delve into five essential trends that are shaping the future of UPI payments.

UPI’s Crucial Role in Driving India’s Cashless Revolution

In 2016, the National Payments Corporation of India (NPCI) launched UPI, which rapidly gained momentum and revolutionized the way Indians handle transactions. Currently, there are 300 million UPI users and 500 million merchants who utilize UPI to accept payments for their businesses. This payment infrastructure allows users to link multiple bank accounts to a single mobile application, enabling real-time, peer-to-peer transactions with just a few taps on a smartphone.

UPI connects over 300 banks and facilitates seamless financial transactions through TPAPs (third-party application providers) such as Google Pay, Amazon Pay, PhonePe, and Paytm in collaboration with banking partners. The open architecture of UPI fosters innovation, enabling developers to create diverse solutions and leading to a vast ecosystem of UPI-enabled apps offering services like bill payments, online shopping, and fund transfers. The user-friendly and accessible nature of UPI has made it highly popular nationwide, bridging the gap between urban and rural areas.

UPI has helped India move towards a more transparent and accountable economy by reducing the use of cash. The data generated by UPI has helped fintech companies and startups grow, which has created new jobs and driven innovation in the financial sector. Moreover, by offering a convenient, cost-effective, and secure digital payment infrastructure, UPI has played a vital role in empowering small businesses, street vendors, and rural communities.

UPI’s Global Reach through Cross-Border Payments

UPI, India’s homegrown payment solution, is gaining international acceptance and is poised to become even more popular in foreign markets. The Indian government has extended UPI services to several countries, making it easier for Indian travelers to make payments abroad and reducing the cost of remittances. UPI is already accepted in countries such as France, Bhutan, Nepal, Oman, UAE, Vietnam, Singapore, Cambodia, Hong Kong, Taiwan, Sri Lanka, Mauritius, the United Kingdom, and Europe.

India’s robust digital payment ecosystem is also attracting attention from other countries. UPI has been signed as a model for digital payments in 15 countries, including Malaysia, Thailand, Philippines, South Korea, and Japan. Nepal has already adopted UPI as its payment platform, and other countries are likely to follow suit.

Experts predict that UPI transaction volumes will continue to grow, further expanding the platform’s global reach. As UPI becomes more accessible to a wider range of users, the scale of UPI transactions is likely to increase significantly. The success of UPI demonstrates the global potential of India’s Make-in-India innovation, and it is a major contributor to the Digital India initiative. Travelers can now enjoy the convenience of easy, seamless, and hassle-free UPI transactions wherever they go.

UPI’s Linkage with RuPay

The integration of RuPay credit cards with UPI marks a significant advancement in the digital payments landscape, offering a fusion of the best features of credit cards and UPI to enhance the payment experience for consumers.

With UPI already being a favored payment method in India, the linking of credit cards to UPI adds another layer of convenience for consumers. Now, users can seamlessly utilize their credit cards to make payments through UPI, streamlining the transaction process and providing a unified payment solution. This integration is particularly advantageous in areas where Point-of-Sale (POS) terminals might be scarce, as it empowers consumers to make payments with ease using their credit cards, regardless of the availability of traditional payment infrastructure.

Apart from the convenience factor, the integration of RuPay credit cards with UPI also bolsters the security aspect of digital transactions. By securely storing card data on the user’s device, the risk of data theft, skimming, or unauthorized access is minimized. This proactive approach to data security instills confidence in consumers and contributes to building trust in digital payment systems.

Overall, the integration of RuPay credit cards with UPI is a pivotal step in enhancing the Indian digital payments landscape. It not only simplifies the payment process but also provides an added layer of security, encouraging more consumers to adopt digital payment methods. This synergy between credit cards and UPI is poised to accelerate the growth of digital payments in India, driving the nation further towards its goal of becoming a cashless society.

UPI 123Pay as Instant Payment Facility for Feature Phone Users

UPI 123Pay is a new feature phone-based payment system that was introduced in India last year. It allows feature phone users to make digital payments without the need for a smartphone or internet connection.

UPI 123Pay offers four different ways to make payments:

- IVR: Users can dial an IVR number and follow the instructions to make a payment.

- App: There is a dedicated app for UPI 123Pay that can be downloaded on feature phones.

- Missed call: Users can make a missed call to a designated number to make a payment.

- Proximity sound: Users can make a payment by holding their feature phone near another feature phone that is also using UPI 123Pay.

UPI 123Pay is available in multiple regional languages, making it accessible to a wider range of users. It is also a very simple system to use, making it easy for even the most tech-challenged users to get started.

UPI 123Pay has the potential to revolutionize the way that feature phone users make payments in India. It is a simple, secure, and accessible system that can help to bring millions of new users into the digital payments fold.

The introduction of UPI 123Pay is a major step forward for financial inclusion in India. It is a game-changer that has the potential to make digital payments more accessible to millions of people who would otherwise be left behind.

UPI AutoPay Feature for Recurring Payments

UPI Autopay is an innovative and user-friendly feature that streamlines the process of handling recurring payments, providing a hassle-free and secure experience for users. By incorporating UPI Autopay into their digital payment arsenal, individuals can bid farewell to the tedious task of manually authorizing payments every time a recurring expense arises.

The setup process for UPI Autopay is simple and straightforward. All users need to do is link their bank account to the UPI app, which establishes a secure connection between their financial institution and the payment platform. Once this linkage is in place, users gain the ability to create recurring payment instructions for any amount and at any interval that suits their specific needs.

The flexibility of UPI Autopay allows users to automate various types of recurring expenses effortlessly. For instance, individuals can utilize this feature to seamlessly settle their utility bills, ensure timely payment of online subscriptions, manage their loan equated monthly installments (EMIs) efficiently, or even cover insurance premiums promptly. The beauty of UPI Autopay lies in the fact that once these payment instructions are set up, users can rest easy, knowing that their payments will be automatically debited from their linked bank account on the designated dates.

The convenience offered by UPI Autopay extends beyond time-saving benefits, as it also plays a crucial role in reducing the risk of missing payments. With this feature in place, users can confidently eliminate any concerns about accidental delays or oversights, preventing late fees, penalties, and potential disruptions in services. Moreover, the added layer of security provided by the UPI framework ensures that users’ financial data remains protected throughout the entire process.

UPI OneWorld for International Tourists

The Reserve Bank of India (RBI) has taken a significant step towards enhancing the convenience of foreign travelers visiting India by introducing UPI One World, a groundbreaking feature that empowers them to make seamless payments using the Unified Payments Interface (UPI).

The mechanism of UPI One World revolves around linking a prepaid payment instrument (PPI) wallet to the UPI system. This wallet can be easily loaded with funds in the local currency, eliminating the need for foreign travelers to carry excessive amounts of cash or rely on international credit or debit cards during their stay in the country. The versatility of UPI One World enables foreign tourists to effortlessly make payments at any merchant outlet that accepts QR-based UPI transactions, transforming their payment experiences into a hassle-free and secure affair.

The initial rollout of UPI One World focuses on tourists from G-20 countries, marking a strategic approach to introduce the feature to a select group of travelers. To ensure easy accessibility, the PPI wallets will be made available at designated Indian airports, further simplifying the process for foreign travelers to avail themselves of this cutting-edge facility. Additionally, the RBI has collaborated with two banks and two non-bank PPI issuers to offer this service to foreign nationals beyond the airport premises, ensuring widespread availability and convenience.

Looking ahead, the RBI has ambitious plans to expand UPI One World to encompass all foreign nationals visiting India, representing a remarkable stride towards enhancing the digital payment landscape in the country. This visionary move is expected to significantly boost the scale of UPI transactions, showcasing India’s prowess in the digital payment industry and further cementing its position as a leader in the global fintech arena.

Foreign travelers stand to reap numerous benefits from UPI One World. Firstly, they can make payments in the local currency, sparing them the complexities and uncertainties of foreign exchange fees. Moreover, the system’s integration with the UPI platform ensures a secure and efficient payment experience, safeguarding their financial data throughout the transaction process. By eradicating the need to carry substantial amounts of cash or depend on foreign cards, UPI One World fosters a more carefree and enjoyable journey for tourists, leaving them with cherished memories of their time in India.

In conclusion, the dynamic UPI ecosystem has revolutionized India’s digital payments landscape, championing financial inclusion and propelling the nation towards a cashless future. As a transformative force, UPI has emerged as a game-changer in India’s journey towards a digital economy, facilitating seamless, secure, and inclusive transactions that have empowered millions and spurred economic growth.

As UPI continues to evolve and innovate, its digital prowess promises to propel India even further into the future, leaving an indelible mark on the global digital payments landscape. Notably, UPI’s transformative impact is extending beyond Indian borders, as it becomes increasingly accessible to non-resident Indians in multiple countries, expanding its reach and influence on a global scale. Through its remarkable journey, UPI has reshaped India’s payment sector and exemplified its potential to shape the digital payment landscape worldwide.