The “New India” that has emerged in the last 10 years has transformed itself from being a mere onlooker to a global leader in various spheres. One of the key enablers for this change is the government’s enhanced focus on making technology and digital solutions central to governance.

The rapid digitization that has been witnessed in the last decade has not only increased the transparency of governance but also made it more efficient and effective. From an era of the digital divide where technology usage was minimal, India has come a long way and is now leading a global revolution of digitization in the arena of digital delivery of public services, procurement of goods, and affordable mobile data thus enabling ease of living using technology for its people.

In this India of the 21st century, the focus is on ‘self-reliance’ through technology-enabled development. To achieve this, the government is investing heavily in technology and creating modern digital infrastructure so that the digital revolution reaches every section of society.

As a first step towards digital revolution, “Digital India” was launched as a flagship program by PM Modi in 2015 with a vision to transform India into a digitally empowered society and knowledge economy wherein all Indians have easy access to the internet.

With the motto “Power to Empower” the key objectives of Digital India program were:

- Digital Infrastructure as a Utility to Every Citizen

- Governance and Services on Demand

- Digital Empowerment of Citizens

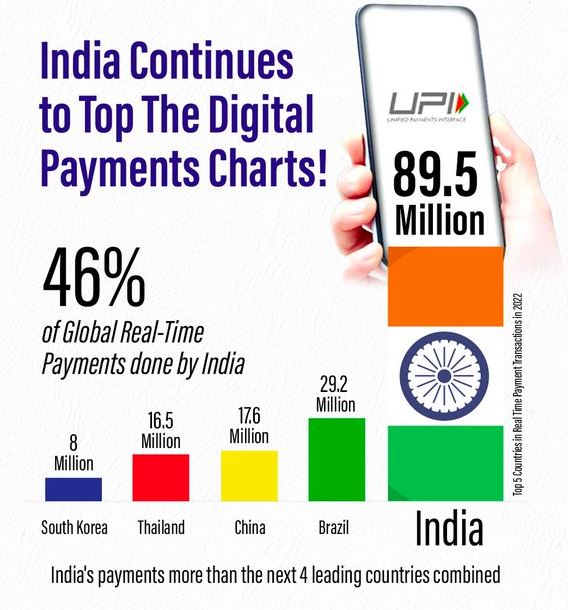

India’s successful transition to a digital payments landscape is a testament to the visionary ‘Digital India’ initiative. The drive aimed at transforming India into a digitally empowered society has indeed reshaped the nation’s financial infrastructure. The advent of cutting-edge payment systems like UPI, digital wallets, and mobile banking has revolutionized the way millions carry out their daily transactions. Coupled with a surge in smartphone usage and internet penetration, the initiative has successfully bridged the financial divide, bringing banking and financial services to the doorstep of the unbanked. The success of digital payments in India exemplifies the power of technology in stimulating economic growth and financial inclusivity, cementing India’s position as a global leader in digital payments.

Key Initiatives by Government for Digital India

Aadhar

It is a 12-digit biometric and demographic based identity number that is unique and provides single source offline/online identity verification across the country for the residents Over 135.5 crore residents of India have been enrolled in Aadhar as on Dec, 2022.

MyGov

It is a citizen engagement platform which facilitate participatory governance and registered users can participate in various activities on this platform. There are over 2.76+ crore users registered with MyGov

DigiLocker

Digital Locker provides an ecosystem with collection of repositories and gateways for issuers to upload the documents in the digital repositories. It is very useful for companies and organisations as they can store their documents and share them with government agencies easily. Digital Locker has more than 13.7 crore users and more than 562 crore documents are made available through DigiLocker from 2,311 issuer organisations.

CO-WIN

It is an open platform for management of registration, appointment scheduling & managing vaccination certificates for Covid-19. It has registered 110 crore persons and has facilitated administration of 220 crore doses of vaccinations.

Aarogya Setu

It is a coronavirus tracker mobile app that not only helped the health ministry in detecting covid clusters in India but also helped the people in self-diagnosis as well as stay updated on covid cases locally in their vicinity as well nationally.

Unified Mobile Application for New-age Governance (UMANG)

This digital platform, dedicated to offering government services to citizens, boasts more than 22,000 e-services available via its mobile app. To date, it has amassed a user base of 5.2 crore registered users.

Common Service Centres

These centres were created to offer government and business services in digital mode in rural areas. Around 5.2 lakh Common Service Centres are operational and providing services in banking, insurance, state and central government services, passport and PAN card services, digital literacy, rural eCommerce services and pre-litigation advice to rural population.

E-sign

This facilitates instant signing of forms/documents online by citizens in a legally acceptable form and is leveraged using OTP based authentication method

MeriPehchaan

It is a National Single Sign-on (NSSO) platform to facilitate / provide citizens ease of access to government portals. There are 4419 services of various Ministries/States integrated with NSSO.

Digital Village

In the ’Digital Village’ , 700 Gram Panchayats (GPs)/Village with at least one Gram Panchayat/Village per District per State/UT are being covered under the project. The digital services being offered are Digital Health Services, Education Service, Financial Services, Skill Development, Solar panel powered street lights including Government to Citizens Services (G2C), Business to Citizen (B2C) Services.

National Rollout of eDistrict MMP

The e-District Mission Mode Project (MMP) aims at electronic delivery of identified high volume citizen centric services at the district or sub-district level. Presently 4,671 e-services have been launched in 709 districts across India.

Open Government Data Platform

To facilitate data sharing and promote innovation over non-personal data, Open Government Data platform has been developed. More than 5.93 lakh datasets across 12,940+ catalogues are published. The platform has facilitated 94.8 lakh downloads.

One Nation One Ration Card

The One Nation One Ration Card (ONORC) scheme is a technology-driven initiative of the Government of India to ensure food security for migrant beneficiaries under the National Food Security Act (NFSA). It allows NFSA beneficiaries to lift their entitled foodgrains from any Fair Price Shop (FPS) in the country through their existing ration card with biometric/Aadhaar authentication.

The ONORC scheme was launched in August 2019 and has been successfully implemented in all states and union territories of India. As of March 2023, over 77 crore portable transactions have been recorded under the scheme.

eHospital/ Online Registration System (ORS)

e-Hospital application is the Hospital Management Information System for internal workflows and processes of hospitals. Currently, 753 Hospitals have been on-boarded on e-Hospital and ORS has been adopted by 557 hospitals across the country with over 68 lakh appointments booked from ORS.

Jeevan Pramaan

Jeevan Pramaan envisages to digitize the whole process of securing the life certificate for Pensioner. With this initiative, the pensioner is no more required to physically present himself or herself in front of disbursing agency or the certification authority. Over 685.42 lakh Digital Life certificates have been processed since 2014.

NCOG-GIS Applications

National Centre of Geo-informatics (NCoG) project, is a GIS platform developed for sharing, collaboration, location-based analytics and decision support system for Departments. So far, 659 applications across various domains are operational.

National Knowledge Network

A high speed data communication network has been established to interconnect Institution of higher learning, and research. So far, 1752 links to Institutions have been commissioned and made operational. 522 NKN links have been connected to NIC district centres across India.

FutureSkills Prime

MeitY in collaboration with NASSCOM has initiated a programme titled FutureSkills PRIME. The programme is aimed at re-skilling/ up-skilling of IT professionals in 10 new/emerging technologies which include Augmented/Virtual Reality, Internet of Things, Big Data Analytics, Artificial Intelligence, Robotic Process Automation, Additive Manufacturing/ 3D Printing, Cloud Computing, Social & Mobile, Cyber Security and Blockchain.

UPI (Unified Payment Interface)

In the India’s story of financial revolution, Unified Payment Interface (UPI) can be termed as the flag-bearer of revolution. UPI which is the leading digital payment platform that facilitates transfer of money between bank accounts and merchants and allows instant real-time payments has changed the dynamics of a robust cash-based economy into digital payment industry.

UPI has onboarded more than 410 banks and in a single month of March 2023, 865 crore UPI transactions of worth 14 Trillion (or 1404950 crore) were facilitated through UPI. By June 2023, the total volume of transactions since April 2016 has surpassed an astounding Rs 309.7 lakh crore. During covid pandemic times, when banks and ATMs were shut during lockdown, AEPS (Aadhar Enabled Payment System) based micro-ATM at CSCs and post offices provided doorstep delivery of cash. Unified Payment Interface (UPI) has become globally attractive and to enable seamless cross-border transactions,

India had signed memoranda of understanding (MoUs) with 13 countries that want to adopt the UPI interface for digital payments and Singapore has already completed its UPI integration as on Feb, 2023. Also, Japan is in discussions with the Indian government to join India’s UPI payment system as of May, 2023.

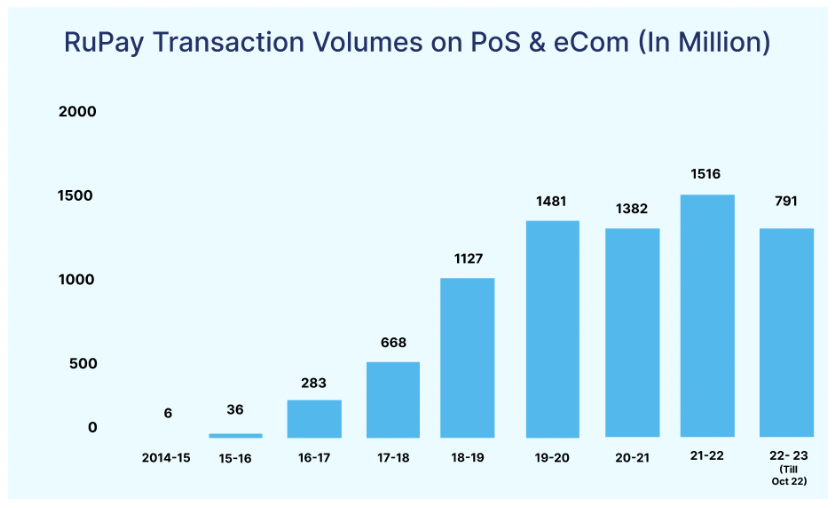

RuPay

RuPay is a Global Card payment network from India that has a wide acceptance across shops, ATM and online transactions. It has made a significant impact on the retail payment industry and offers excellent privileges and benefits such as International Acceptance, Domestic and International Airport Lounge Access, free personal accidental death and permanent total disability insurance coverage, various merchant offers, different Cashback scheme, Health and Wellness benefits to appeal to the mass and affluent customers.

This indigenous based card-payment system RuPay has been a massive success story and has achieved a highest benchmark of 1516 million transactions in 2021-22.

Pradhan Mantri Gramin Digital Saksharta Abhiyan (PMGDISHA)

Pradhan Mantri Gramin Digital Saksharta Abhiyan (PMGDISHA), an impressive initiative launched by the government in 2019, stands as a commendable effort to bridge the digital divide. The primary objective of this scheme is to provide digital literacy to the rural population, with a target of empowering six crore individuals, including those from impoverished and marginalized backgrounds. The program focuses on imparting essential computer and digital device operating skills to residents of rural areas.

The impact of PMGDISHA has been significant, with a remarkable registration count of 6.92 crore candidates. Furthermore, the scheme has successfully trained 5.96 crore individuals, equipping them with the necessary knowledge and proficiency in digital technologies. As of May 2023, an impressive 4.44 crore students have received certification, indicating their successful completion of the program and validation of their digital literacy skills.

PMGDISHA plays a vital role in narrowing the digital divide that exists in rural India, ensuring that individuals from all sections of society have the opportunity to access and benefit from digital technologies. By providing digital literacy training, the scheme empowers the rural population, enabling them to participate actively in the digital economy and access essential online services. It serves as a catalyst for their personal and professional growth, fostering inclusivity and equal opportunities for the rural communities.

SWAYAM

SWAYAM, launched in 2017, stands as a significant government initiative in advancing digital literacy throughout India. Serving as a digital mentor to students and teachers nationwide, this project plays a pivotal role in making education more accessible and inclusive. With the aim of bringing disadvantaged students into the educational mainstream, SWAYAM has proven to be a transformative force, particularly during the challenging period of lockdowns and disruptions.

The impact of SWAYAM has been remarkable, providing a digital platform that empowers students and educators with diverse learning opportunities. By leveraging technology, this initiative breaks barriers of distance and limited resources, allowing individuals from all corners of the country to access quality educational resources and courses. Through SWAYAM, students gain the flexibility to learn at their own pace, enhancing their knowledge and skills across various disciplines.

Furthermore, SWAYAM has been instrumental in supporting students during the lockdown period. With traditional educational institutions temporarily closed, this digital initiative ensured continuity in learning, offering a wide range of online courses and educational resources. It proved to be a lifeline for students, providing them with a structured and engaging learning experience from the comfort of their homes.

In addition to this, since the internet is becoming progressively more prominent, the government and private sector together have laid over 25 lakh kilometer optical fibre in the last nine years and this has helped the spread of internet usage even in the remote corners of the country. As an outcome, internet users in India have more than doubled in the last 5 years.

Also, among 120 crore subscribers in India in 2021, more than 75 crore use smartphones and India is among the few countries that have the lowest data tariff across the world which clearly indicates that India is taking its rightful place in the world as a digitally empowered nation.

Along with this, India has traversed a long journey from being a user of telecom to becoming a big exporter of telecom technology due to the advancement in technology and consistent efforts of government. India has placed itself among the few countries that have rolled out 5G mobile technology at the fastest pace.

Within 120 days of the launch of 5G, the services have been already expanded to 125 cities which was a big achievement. Moving ahead, India has now started catalyzing the next-generation 6G research and innovation in the country to enable India to be a front-line contributor in 6G technology and manufacturing by 2030.

The government is leveraging technology in the arena of procurement as well and has created the GeM portal, which allows small businessmen and even street vendors to participate in government procurement. There is also e-NAM (National Agriculture Market) electronic trading portal which allows farmers to get linked with buyers at different places.

Along with this, leveraging the power of drones and GIS technologies, SVAMITVA Yojana has been providing digital land records to the rightful owners that not only helps to reduce disputes but also facilitate monetisation of land for availing bank loans and enable scientific village level planning. Nearly 2.14 crore land parcels have been digitised so far.

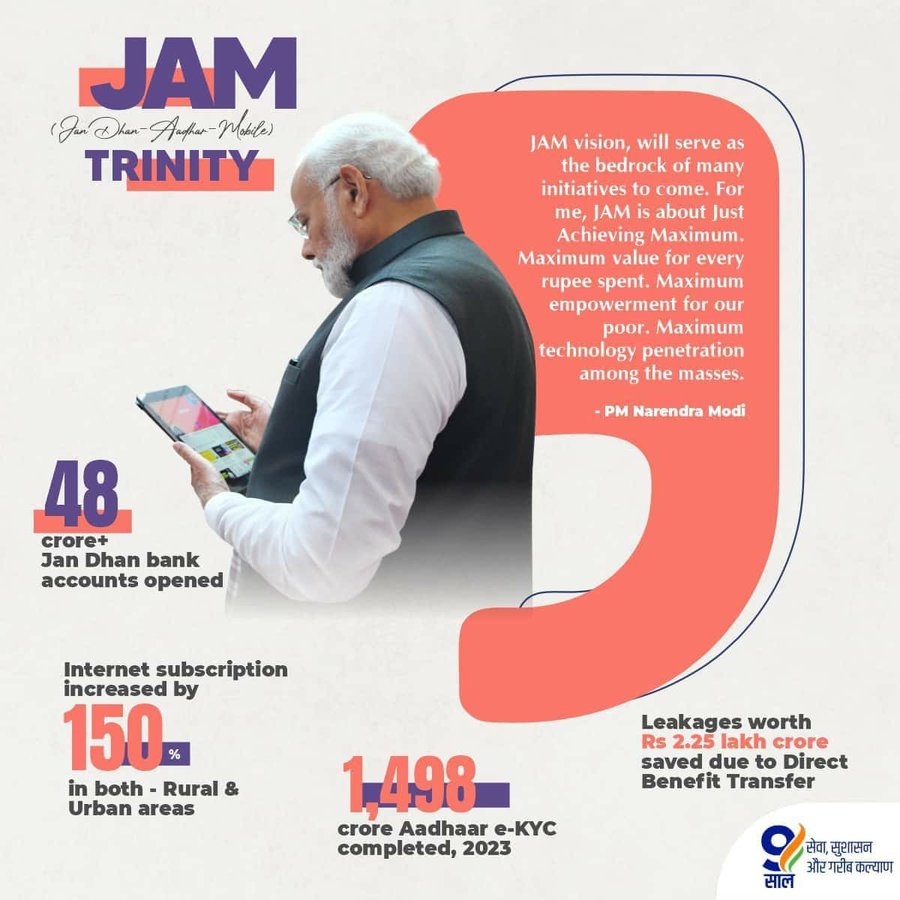

Additionally, Digital India played a vital role during covid pandemic as well and ensured delivery of government schemes to its beneficiaries without any leakage or misuse. The Jan-Dhan-Aadhaar-Mobile (JAM) trinity which comprises of saving bank account opened under Jan-Dhan Yojana, the unique biometric identifier in the form of Aadhaar, and the rapidly increasing Mobile penetration in the country ensured that the poorest receive every penny of their entitled benefits. Aadhar number served as an entry point to identify those who are eligible for various government schemes.

Moreover, Digital interventions have sparked a revolutionary transformation in sectors such as agriculture and health, leveraging the power of technology to drive progress. Noteworthy applications like Kisan Suvidha and Meghdoot have been introduced to provide farmers with vital information and valuable crop advisories, empowering them to make informed decisions. Furthermore, the BharatNet project has played a pivotal role in connecting Gram Panchayats across the nation through broadband connectivity, facilitating communication and access to digital services in rural areas.

As a part of Jan Dhan Yojana, saving bank accounts were opened for people and then government transfers were pushed directly into such accounts. As on 2022, Financial benefits worth nearly Rs 23 lakh crore have been transferred using Direct Benefit Transfer technology.

India is scaling new heights and is now proficient in using technology to solve problems and meet global standards. The technology has not only played a vital role in providing equal opportunities to everyone but is also improving the ease of living. India’s digital payments revolution is being appreciated globally and other countries have started adopting it.

In the Budget of 2022-2023, government has focused extensively on sunrise sectors like AI, Geospatial systems, drones, semiconductors, genomics, space tech and clean tech which is going to further pave the way for transformation using technology. India has clearly emerged as the fastest-growing ecosystem for fintech innovations and success of Digital India clearly showcases that India is emerging to be a tech giant globally by the end of this decade.

References